Enable Now clicks lifted purchases ~190%. Ask Later users saw ~187% purchase growth.

119.6% increase in five-task completion rate

2.2x improvement in premium membership conversion

58% growth in users entering the qualification funnel

N Kolay is a digital banking application established in 2015 by Aktif Bank, Turkey’s largest privately owned investment bank. The application enables individual users to carry out banking services such as money transfers, payments, investments, and credit transactions entirely through digital channels, without the need to visit a branch. It has approximately 9 million users.

N Kolay offers its users a simple, fast, and accessible financial experience through free basic banking transactions, interest-free short-term cash solutions, and investment products. The platform also expands its digital banking services with additional features such as virtual cards, installment shopping options, and investment fund transactions.

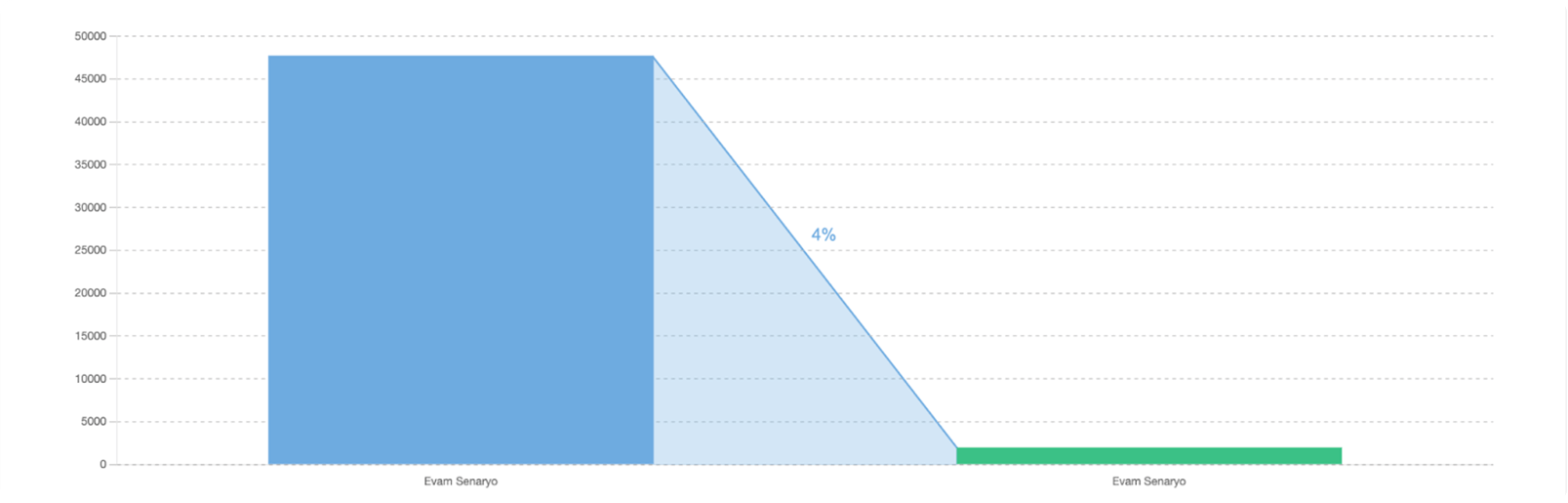

N Kolay needed to increase the number of users who completed its premium membership program. While thousands of users initiated the process by completing the mandatory first step, most abandoned the journey before they finished the remaining required transactions. Without automated communication to guide users through each stage, the bank struggled to convert interested users into active premium members.

After users completed their mandatory initial transaction, they often left the app without realizing they needed to finish additional banking tasks. Users who demonstrated clear intent by starting the process disappeared, and the manual effort required to track and re-engage them at scale was impossible.

N Kolay built a three-step automated journey using Netmera’s real-time behavioral triggers.

The first automated push fired immediately when users completed the mandatory task and informed them they’d taken the first step.

The second push triggered each time users completed another qualifying transaction which reinforced their progress and encouraged continued engagement.

When users finished all five tasks, the third automation congratulated them on achieving N Kolay Extra status.

Their team segmented users with Funnel tracking, created targeted messages for each stage, and set up the automations without technical obstacles.

The completion rate more than doubled. In the baseline period, 4.17% of users who started the process completed all five tasks.

“Our challenge was not demand, but conversion. Users were interested in N Kolay Extra, yet the journey wasn’t clear enough to complete. With behavioral automation, we were able to structure the qualification flow around real user behavior and guide customers step by step through the experience.”

Canan Sayın

Retail Banking Group Product Management and BaaS Senior Director

More users now started entering the qualification funnel, and each user progressed at their own pace. Batch campaigns and one-size-fits-all messages were ineffective.

The automated journey responded to each user’s individual behavior in real time. When someone completed a transaction, the system instantly recognized it and triggered the appropriate next message. Netmera’s self-service platform meant N Kolay’s team could iterate quickly without waiting for technical resources or deployment cycles.

The funnel absorbed a 58% increase in user volume between the baseline period and active campaign period. Consistent performance across quarters proved the solution scaled naturally with business growth and maintained conversion quality at significantly higher volumes.

“Before push automation we set up with Netmera, most users would complete the first transaction and then drop off. Now the system catches them at every step. Our completion rate jumped from 4% to 9% in three months, and it runs completely on its own. That’s thousands more premium members with zero extra effort from our team.”

Duygu Sarısan

Digital Banking and Payment Systems Senior Director

increase in total funnel volume

lift from first deposit to full membership

increase in total funnel volume

Connect with users through push, email, SMS, WhatsApp, and in-app messages from one platform. When push doesn’t work, the system tries email. When email goes unopened, SMS follows.

Run A/B tests on web and app push notifications without writing code. Test message copy, CTAs, or visual elements. See which version drives higher conversion rates and make data-driven decisions fast.

With Best Time Delivery, send messages automatically during each person’s peak engagement window, increasing open rates without manual scheduling.

Enable Now clicks lifted purchases ~190%. Ask Later users saw ~187% purchase growth.

Tam Finans Mobile re-engaged inactive users with automated, personalized campaigns, boosting monthly active users by 40%.

DenizBank cut bounce rates 41% and restored loan application completion to 10% using Funnel Analysis and targeted push notifications.

Subscribe to our newsletter

© 2024 — Netmera. All Rights Reserved. | Privacy Policy | Cookie Policy (EU) | GDPR | KVKK